tax on unrealized gains bill

Theres been a lot of debate this week over President Bidens latest budget plan which includes a proposed tax on the unrealized gains of assets owned by billionaires. A proposed House Ways.

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

At the current top.

. Under the proposed Billionaire. And a mark-to-market system isnt the only. The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax on all income including not just realized.

A tax on unrealized gains is clearly not in compliance with Article I Section 9 nor is it covered under the 16th Amendment which the Supreme Court explicitly ruled in Eisner v. The largest part of the tax bill will be upfront. The taxation on unrealized capital gains is expected to affect people with 1 billion in assets or 100 million in income for three consecutive years.

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Is expected to lose almost 42 billion in tax revenue this year from the exclusion of capital. Plans include an alternative minimum tax on corporate book income an excise tax on stock buybacks and a tax on unrealized capital gains for billionaires.

Contact a Fidelity Advisor. Billionaires and their growing piles of untaxed investment gains. Democratic leadership over the weekend began suggesting a new way to pay for President Bidens multitrillion-dollar social policy and climate action spending bill a tax on.

To increase their effective tax rate. Any fair tax system would give that investor the ability to offset gains with losses as is generally the case elsewhere in the tax code. Of all the many revenue-raising ideas that have bubbled up out of Washington the recent proposal to tax unrealized capital gains is particularly jarring.

Contact a Fidelity Advisor. This would eliminate wealthy individuals ability to defer taxation on assets. Even though reports suggest the proposed.

With their latest tax proposal Democrats are going after an elusive target. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant. A proposal to tax unrealized gains is being considered in the Senate.

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. If your taxable income is below 41675 for single filers or 83350 for married couples filing together in 2022 youll fall into the 0 capital gains bracket. We probably will have a wealth.

To prohibit the implementation of unrealized capital gains taxation. WASHINGTONPresident Biden expressed support for a proposal under consideration in the Senate to place an annual income tax on billionaires unrealized capital. The tax will charge a long-term cap gains rates on all unrealized monies for tradeable investments which includes stocks bonds.

The Problems With an Unrealized Capital Gains Tax. Prohibition on the implementation of new federal requirements to tax unrealized capital. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022.

23 hours agoHeres how it works. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. The tax would apply to 1 million of that 2 million gain due to the exclusion.

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Unrealized Capital Gains Tax For Billionaires Explained

Stop Worrying About The Unrealized Gains Tax Are You Insanely Wealthy Already No Cool Then It Doesn T Apply To You It S Fud Billionaire Fud R Superstonk

Biden Capital Gains Tax Plan Could Raise 113 Billion If Step Up Is Killed

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Biden Proposes New Minimum Tax On Billionaires Unrealized Gains Fox Business

What Is Unrealized Gain Or Loss And Is It Taxed

Will The Unrealized Capital Gains Tax Targeting Billionaires Pass

What The Wyden Proposed Tax On Unrealized Capital Gains May Mean For You

The Details Of Hillary Clinton S Capital Gains Tax Proposal Tax Foundation

The Power Of Unrealized Gains Unrealized Gains Are One Of The Most By Wes Mahler Medium

Here It Is Wyden S Unrealized Capital Gains Tax On Wealthy Americans Swfi

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Will The Unrealized Capital Gains Tax Targeting Billionaires Pass

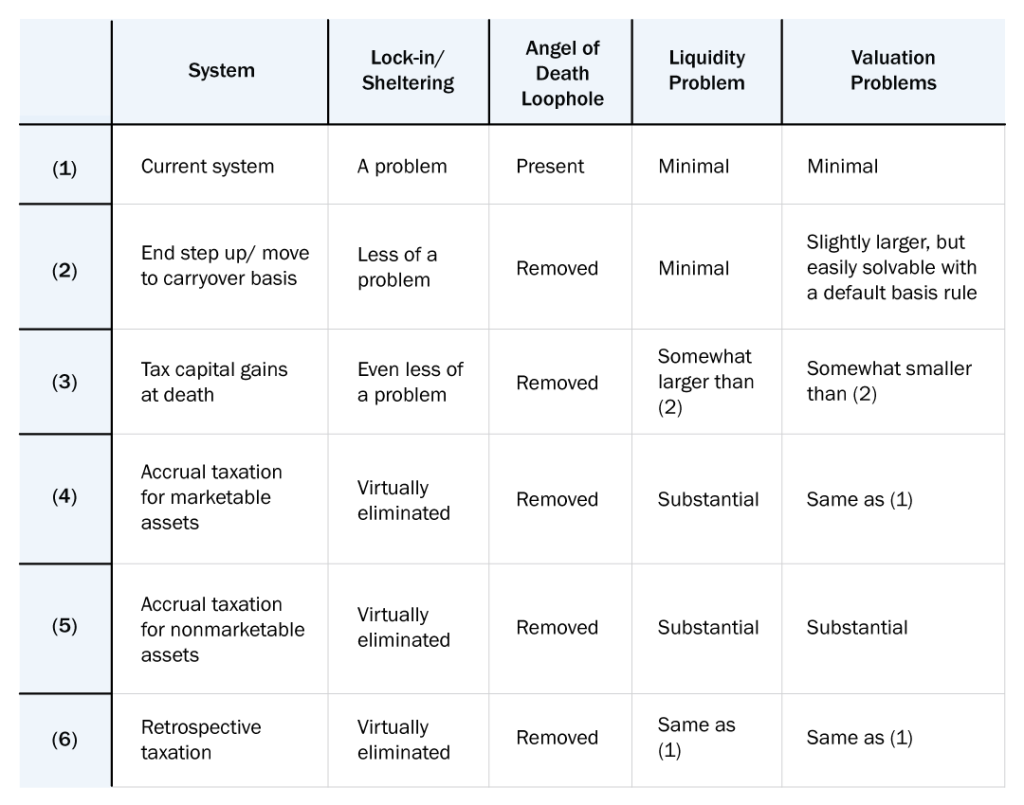

What Are Capital Gains Taxes And How Could They Be Reformed

Democrats Are After Your Money With Wealth Taxes Even A Tax On Unrealized Gains Mish Talk Global Economic Trend Analysis

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)